Reporting a fraud can cost you business!

I recently reported a fraudulent transaction on my personal bank account, resulting in all my accounts being ceased and my cards frozen. Although the bank advertises a one-day investigation period, it took nearly five working days. The conclusion was that the transaction, although fraudulent by definition, was attributed to my negligence due to my phone's biometric security being used. This experience was extremely poor, highlighting significant risks for businesses if any transaction is reported as fraudulent.

The Perils of Reporting Fraudulent Transactions: A Personal Account

In an age where digital transactions are ubiquitous, the threat of fraud looms large for individuals and businesses alike. As an unfortunate testament to this, I recently found myself entangled in a frustrating and bewildering experience after reporting a fraudulent transaction on my personal bank account. This ordeal not only highlighted the inefficiencies within the banking system but also underscored the potential risks for businesses when faced with similar situations.

The Initial Discovery

It all began when I noticed an unfamiliar and unauthorised transaction on my bank statement. Acting swiftly, I reported this to my bank, expecting prompt and decisive action to secure my funds and investigate the matter. Little did I know, this would set off a chain of events that would leave me without access to all of my accounts (including my business accounts) ... for a grand total of £39.99 (£40.01 using their roundup feature). I simply didn't realise reporting a single fraudulent transaction was about to start a whole world of agro!

Ceased Accounts and Frozen Cards

Upon reporting the fraudulent transaction, the bank took immediate action by ceasing all my accounts and freezing my cards. While this measure is understandable from a security standpoint, the abruptness and lack of communication left me in a precarious position. The bank's promise of a thorough investigation within a single working day was a beacon of hope, but this soon proved to be misleading.

A Lengthy Investigation

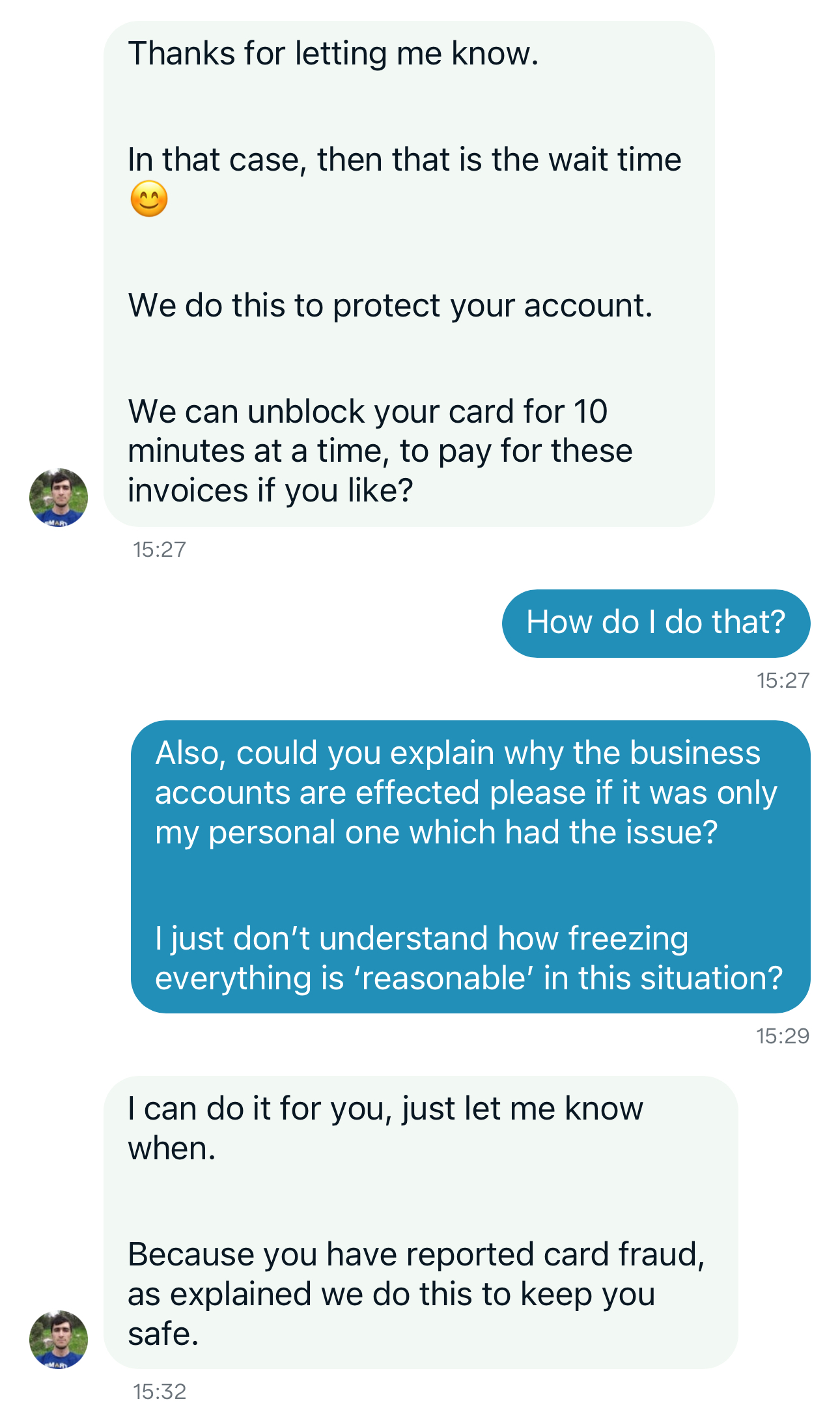

Contrary to the advertised one-day investigation period, it took nearly five working days for the bank to conclude their inquiry. During this time, I was unable to access my funds or use my cards, causing significant inconvenience and stress. The prolonged period of uncertainty was exacerbated by sporadic updates from the bank, leaving me feeling isolated and powerless. The conversation with the support team, together with many popup questions, left me feeling there was a mismatch between the 'specialist' and customer service:

The Unsettling Conclusion

When the investigation finally concluded, the outcome was far from satisfactory. The bank determined that the transaction, while fraudulent by definition, was not their responsibility. They attributed the incident to my phone's biometric security being used to unlock it, effectively placing the blame on me. This reasoning felt like a dismissal of my concerns and a failure to acknowledge the real issue at hand.

Implications for Businesses

This experience raises serious concerns about the potential impact on businesses when fraudulent transactions are reported. If an individual can face such significant disruptions and inadequate resolution, the stakes are even higher for businesses that rely on the smooth functioning of their accounts and transactions. A prolonged investigation and lack of access to funds could lead to operational setbacks, reputational damage, and financial losses.

A Call for Better Practices

In light of this ordeal, it is clear that banks and financial institutions need to reassess their processes for handling fraudulent transaction reports. Transparent communication, realistic timelines, and a more nuanced understanding of security issues are crucial. Customers should not be left feeling blamed and unsupported, especially when they act promptly to protect their financial interests.

Conclusion

My experience with reporting a fraudulent transaction has been a stark reminder of the vulnerabilities within our banking system. It has highlighted the need for better practices and more robust support for customers facing similar situations. For businesses, the risks are even greater, underscoring the importance of proactive measures and contingency planning. Only by addressing these issues can we hope to create a more secure and reliable financial environment for everyone.

As much as I've always been a part of Monzo right from the start... how they first started seems very different to how they are now.

As much as I've always been a part of Monzo right from the start... how they first started seems very different to how they are now.

Shame.